When you need money quickly, pawning valuable jewelry is a quick solution. But the resale value isn’t clear, and can be confusing for some customers. Unfortunately, it isn’t as simple as the appraisal value.

Before you get a loan using jewelry or resell your jewelry, make sure you understand how your piece will be evaluated.

You’ll hear these three terms when you sell jewelry: market value, retail value and assessed value. They may sound similar, but they mean very different things. If you understand each definition, you’ll be more likely to get a good deal.

Market value

The market value of jewelry is based on the cost of labor and materials to make the jewelry. Market value is how much retailers pay manufacturers to sell their products in their stores.

The market value price is slightly higher than the cost of raw materials and labor so that manufacturers make money, too.

Retail value

Just like a manufacturer ups the price of jewelry when selling to a retailer, retailers increase the price when selling to the general public. The retail value is the cost people see online or in store.

Just like all businesses, jewelry stores have to cover their costs and make a profit. That means the retail price is higher because it covers business expenses like employee wages and marketing.

Retail value fluctuates, and is more dependent on trends, style and brand name than market value. The market value is fixed, and based on the cost to buy materials and produce the jewelry piece.

Appraisal value

Most people don’t realize there are multiple types of appraisals, and it is important to get the right type for your situation.

The most common appraisal, called an Insurance Appraisal, is the cost it would take your insurance company to compensate you for lost or stolen jewelry. That goes beyond what the jewelry is made from, and may include extra compensation for sentimental pieces or loss of an heirloom.

Many customers are confused when the resale value of their jewelry doesn’t match the appraisal value. Remember that appraisal value includes the extra costs added by the jewelry retailer and costs for special circumstances. Some pieces that are unique or nearly impossible to replace may have higher appraisal values.

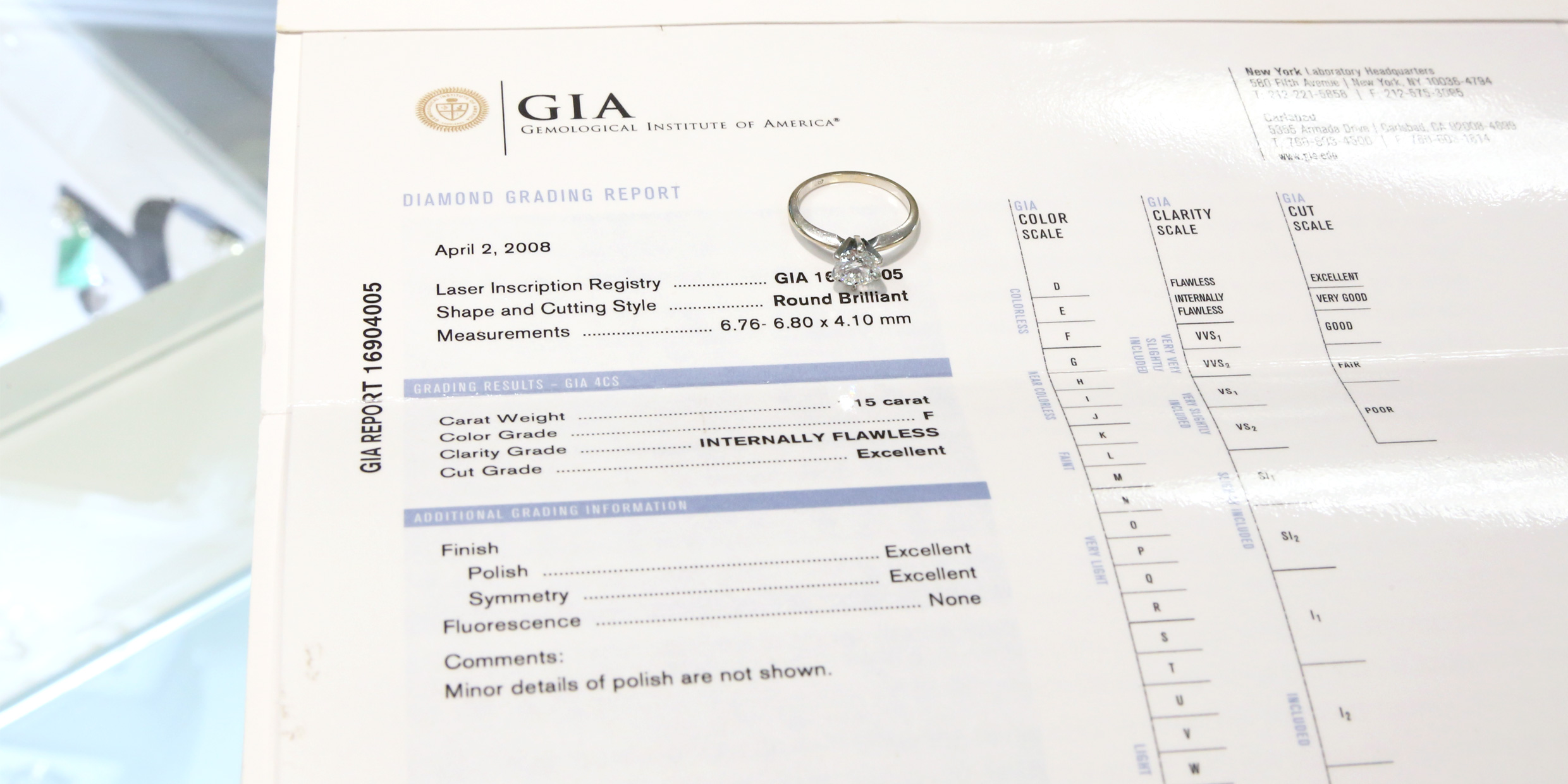

Even though appraisal value isn’t an accurate reflection of resale value, bring in your appraisal papers when selling jewelry. The information on appraisal paperwork like gemstone size will help your jeweler evaluate the piece.

Before selling your jewelry, understand the resale offer you received. That way, you can make an informed decision about accepting it. Another way to ensure you get a fair price is by working with a reputable retailer.

Want to learn more about resale value?

If you want to learn more about the resale value of your jewelry, luxury watch or bullion, visit national lender Diamond Banc. Diamond Banc buys fine jewelry from the public and provides short-term asset-based loans on jewelry and watches.

Diamond Banc experts can answer your questions about resale value and tell you how much you could sell your jewelry for.

Visit one of Diamond Banc’s locations today, or call 1-855-342-2262 for more information.